The American Recovery Plan Act of 2021

The following article was authored by firm attorney Brian M. Bentrup and was first published on the Chicago Bar Association’s Young Lawyers Section website on April 5, 2021.

The United States Congress passed three pieces of legislation designed to counteract the effects of the COVID-19 pandemic. Former President Donald J. Trump signed the Families First Coronavirus Response Act (the “FFCRA”) into law on March 18, 2020, and the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) into law on March 27, 2020. The FFCRA is employee-focused and aimed at providing financial relief for aid sick leave. The CARES Act is employer-focused and designed to provide economic stimulus to businesses affected by COVID-19. The CARES Act also included direct economic impact payments of $1,200 per adult and $600 per dependent, and later legislation included a second direct economic impact payment of $600 per person.

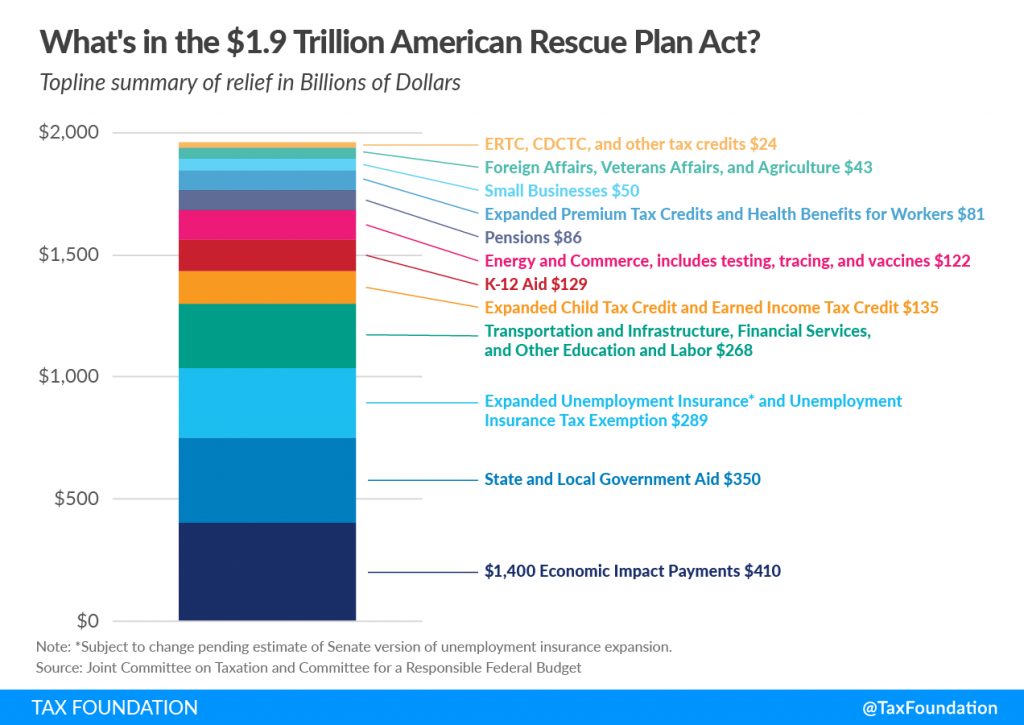

President Joseph Biden signed the American Rescue Plan Act of 2021 (“ARPA”) into law on March 11, 2021. The new $1.9 trillion plan brings the total governmental relief balance to roughly $6 trillion. While much of the focus is on the direct economic impact payments to individuals, which at $1,400 per person is the largest to date, there are many other important provisions. Nevertheless, direct payments to individuals comprise $410 billion, which is the largest portion.

Image provided by Tax Foundation, retrieved March 18, 2021 at https://taxfoundation.org/american-rescue-plan-covid-relief/

State and Local Government Aid – $350 billion

States will receive $195.3 billion in revenue to help offset losses resulting from the pandemic. Local governments will receive $130.2 billion, split evenly between cities and counties, with aid to cities based on the existing formula and county aid based on population. The remaining $24.5 billion in the state and local aid packages will provide $20 billion in assistance to tribal governments and $4.5 billion to U.S. territories.

Included in the state and local governmental aid is $60 billion to counties and $10 billion for a Coronavirus Capital Projects Fund.

The ARPA also allocates nearly $50 billion to assist with housing costs, particularly for low-income individuals at-risk of becoming homeless. It further extends a 15% increase in food stamp benefits. The measures are intended to help reduce the number of individuals living below poverty-level.

Expanded Unemployment Insurance and Insurance Tax Exemption – $289 Billion

The ARPA extends the three federal unemployment insurance expansions first created by the CARES Act through September 6, 2021, adding a weekly $300 supplement to state unemployment benefits. It also provides 53 weeks of federal unemployment insurance benefits after the state benefits end, up from 24 weeks.

The ARPA exempts $10,200 of unemployment benefits received in 2020 from income taxes and the exclusion is retroactive, applying to unemployment insurance benefits received last year, largely to reduce the issue of surprise tax bills. It is limited to individuals making less than $150,000.

Transportation and Infrastructure, Financial Services, and Other Education and Labor – $268 billion

The ARPA includes $20 billion to improve public transit systems, including airports, Amtrak, and transit systems in major metropolitan areas. It allocates $40 billion for higher education and forgiven student loan debt is made tax-free. It further allocates $1.85 billion for cybersecurity and $3 billion to assist aviation manufacturers.

The ARPA provides a tax credit to employers who choose to offer paid sick leave and paid family leave benefits.

Child Tax Credit – $135 billion

The ARPA expands the child tax credit by allowing qualifying families to offset, for the 2021 tax year, $3,000 per child up to age 17 and $3,600 per child under age 6. The child tax credit reduces tax liability dollar-for-dollar of the value of the credit.

Taxpayers may claim a maximum credit of $2,000 for each child, with a portion of the credit refundable. The credit is designed to benefit low-income families with workers and children and can significantly boost incomes and lift families above the poverty line.

K-12 Aid – $129 billion

The ARPA allocates $129 billion to reopening by hiring more staff and putting in place new testing protocols, social distancing, additional staff as well as funds for institutions of higher education. It also includes money aimed to increase broadband access for remote learning.

Energy and Commerce, including testing, tracing, and vaccines – $122 billion

The ARPA allocates $50 billion to the Federal Emergency Management Agency for vaccine distribution and assistance, $47.8 billion for critical investments to bolster the nation’s COVID-19 response, with resources for vaccines, treatment, testing, contact tracing, personal protective equipment and workforce development, and $13.48 billion to the Department of Veterans Affairs for assistance.

It also allocates $10 billion to improve testing and vaccine administration under the Defense Production Act and approximately $8.5 billion will reimburse rural health care providers for health care-related expenses and lost revenues attributable to COVID–19.

The ARPA expands access to governmental medical programs and includes money to increase access to health coverage for those who lose insurance or are uninsured. It includes additional continuation options for COBRA.

Pensions – $86

The ARPA allocates $86 billion for approximately 185 multiemployer pension funds that are close to insolvency. The pension funds collectively cover 10.7 million workers.

Small Business – $50 Billion

The ARPA provides direct grants to restaurants and bars totaling $28.6 billion and Emergency Injury Disaster Loans (a long-term, low-interest loan program of the Small Business Administration) totaling $15 billion. It also allocates $7 billion to expand eligibility and resources for the Paycheck Protection Program, which has been administered intermittently throughout 2020-21.

About the Author:

Brian M. Bentrup is a graduate of Loyola University Chicago where he triple-majored in Economics, Political Science, and Psychology. In 2015, he obtained his law degree from The John Marshall Law School. In law school, Brian was selected to be an extern for the Honorable Laura C. Liu in the Mortgage Foreclosure and Mechanics Lien Division as well as the Illinois Tenant Union.

Brian joined MacDonald, Lee & Senechalle, Ltd. in January 2018. His practice includes estate planning, probate and trust administration, and residential and commercial real estate. Brian also focuses on guardianships of minors and disabled adults and has been named to the approved Guardian ad Litem lists for Cook County, DuPage County, Kane County and Lake County. Brian dedicates time to pro bono work with Chicago Volunteer Legal Services representing or advocating on behalf of minors and disabled adults.

Brian is a member of the American Bar, Illinois State Bar, Cook County Bar, DuPage County Bar, and Chicago Bar Associations. He is also a member of the Justinian Society of Lawyers and the Phi Alpha Delta Law Fraternity.

Brian is licensed to practice in Illinois and Missouri. When not practicing law, Brian enjoys spending time with his wife, daughter and son, and exploring new and different culinary experiences.